How to EPF Withdrawal or Transfer Your Employee PF Amount, EPF PF Amount with Interest rates, Withdraw PF Amount easily, EPF Transfer Procedure through EPFO Portal, How to Transfer PF Funds Easily to another PF Account, PF Transfer Online at https://unifiedportal-mem.epfindia.gov.in/…

EPF is a investment scheme for salaried persons in India, an employee can made Provident Fund (PF) amount during his period of being an employee, provident fund amount is calculated as 12% of person basic salary, the same amount is contributed by the employer, among that 12% of PF amount 3.67% is contributed to provident fund & 8.33% is deposited in Pension scheme. There are some advantages of having an EPF Account they are Tax benefit Under Section 80C, Retirement benefit, Withdrawal benefit.

NOTE: Here are the some forms required:

- Form NO. 2 is required to be filled to become the member of the provident withdrawal fund it Resources and Information, is called a Nomination Form .

- Form No. 13 is required for transfer of Provident fund.

- Form No. 19 is required for withdrawal of provident fund

- Form No. 10C is required for withdrawal of pension fund.

How to EPF Withdrawal or Transfer Your Employee PF Amount

EPF Withdrawal:

You can withdraw you PF amount during or in middle of when you are doing job. By using Universal Account Number (UAN) you can directly withdraw PF amount using form-19 which is available at employer and at official website www.epfindia.gov.in. below we are providing step by step process for EPF Withdrawal.

Withdrawal form Regional office

- You can withdrawal the PF amount from the Regional Office or neared by EPF Office.

- Take the Form-19 (PF Withdraw Form as given above) from the Regional PF Officer

- if there is no regional office then download it from the official website of http://epfindi.gov.in.

- Fill in the form completely with necessary details, take attestation form any Bank Manager or any government employee.

- Then attach a letter discussing about reason behind withdrawal of amount.

- if you have employment letter just attach it actually it is not necessary to attach.

- Then submit your application form to the Regional office after submitting your application you will receive your PF amount within 3 months form the date of submission of form-19.

Do not withdraw your amount before 5 years other wise you will pay the tax on the amount of interest, so withdraw you amount after completion of 5 years of period of your PF account without pay of tax. so, Provident Fund amount is useful to the employee’s after retirement of their job.

Procedure to transfer PF online

Every employee know that now transferring of PF amount made online through unified portal, below we are given step-by step procedure for PF transfer process through online.

- First open the URL https://unifiedportal-mem.epfindia.gov.in/.

- Then login to Unified portal by using your UAN number followed by password.

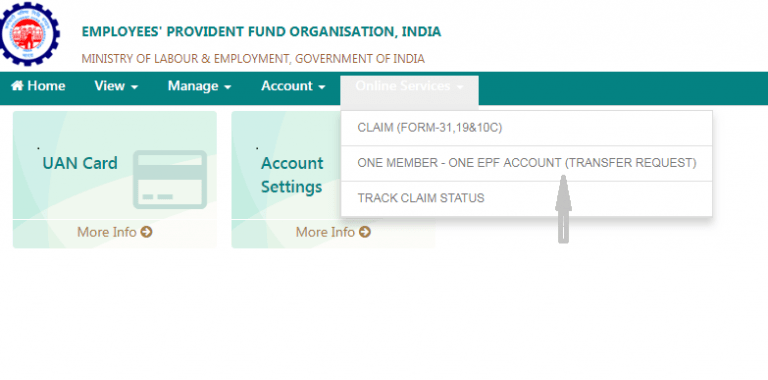

- After login click on One Member – One EPF Account under Online Services as show in below picture.

- Then Verify personal information and PF account for present employment.

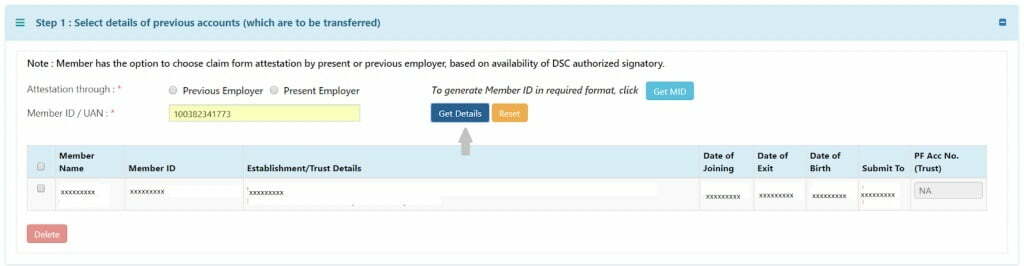

- PF A/C details of previous employment would appear on clicking on ‘Get details’ shown below.

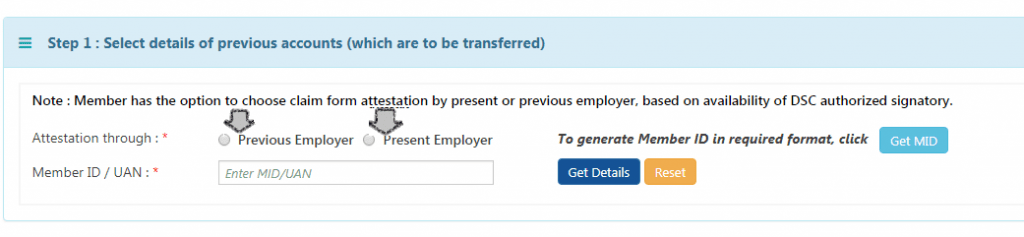

- Then you have to choose either previous employer or current employer for attesting the claim form based on the availability of authorized signatory holding DSC after choosing enter your UAN A/C number.

- then click on OTP option, then you will receive a OTP from UAN registered mobile number then enter it and hit submit button.

Finally employer will approve your PF amount transfer request digitally, then fill form-13 with all necessary details and Submit the physical signed copy of the online PF transfer claim form to the selected employer within a period of 10 days.